#Blockchain Transparency

Explore tagged Tumblr posts

Text

#Retail Inventory Management#Microservices Architecture#Event-Driven Architecture#AI in Retail#IoT Integration#Blockchain Transparency#Real-Time Data Processing#Supply Chain Optimization#Retail Technology#Inventory Optimization

0 notes

Video

youtube

Blockchain Basics: A Simple Guide

0 notes

Text

Blockchain technology is reshaping the dairy industry by enhancing traceability, transparency, food safety, and sustainability. By leveraging blockchain solutions, dairy companies can optimize supply chain management, improve operational efficiency, and meet the evolving demands of consumers for safe, high-quality dairy products. Embracing blockchain represents a transformative step forward for the dairy industry, heralding a future of innovation, trust, and accountability.

For dairy companies seeking to remain competitive in a rapidly evolving landscape, embracing blockchain technology is not just a choice but a strategic imperative. By harnessing the power of blockchain, dairy businesses can unlock new opportunities for growth, differentiation, and value creation in the global marketplace.

#blockchain#blockchaindevelopment#blockchaintechnology#blockchain transparency#blockchain safety#seracle blockchain

0 notes

Text

Technology Trends 2024: Importance of Trust

Introduction

The introduction sets the stage by emphasizing the centrality of trust in the rapidly evolving tech landscape of 2024. You convey how this guide will delve into the interconnectedness of trust and technology, highlighting how trust acts as the foundation for embracing and leveraging emerging trends.

Navigating the Tech Trends of 2024

This section delves into the prominent technology trends of 2024 and how trust is interwoven with each of them:

1. Ethical AI and Algorithm Transparency:

Here, you elaborate on how trust in AI is inseparable from transparency. You explain how ethical AI practices, including understandable and accountable algorithms, are vital for building trust among users who want to comprehend and trust the decisions made by AI systems.

2. Data Privacy and Security:

In this part, you explore the increasing significance of data privacy and security. You detail how tech trends in 2024 emphasize the need for robust data protection mechanisms, ensuring individuals have control over their personal data, and how this fosters trust among users.

3. Human-Centered Design:

This section delves into the concept of human-centered design. You explain how user-centric technology is crucial for building trust, as user-friendly, inclusive, and accessible designs resonate with users and mitigate the fear of complex tech systems.

4. Sustainable Tech Solutions:

Here, you elaborate on the intersection of sustainability and trust in technology. You discuss how eco-conscious solutions build trust among users who prioritize ethical consumption and resonate with the notion that technology can coexist harmoniously with the environment.

5. Blockchain for Transparency:

This part explores the transformative potential of blockchain technology. You detail how blockchain's tamper-proof nature enhances transparency, reinforcing trust in transactions, particularly in sectors where transparency is paramount, such as finance and supply chain management.

6. Digital Well-Being Focus:

You dive into the significance of tech's impact on mental health. You discuss how tech trends in 2024 prioritize digital well-being features, addressing potential negative effects of excessive technology usage and thereby building trust by caring for users' holistic well-being.

The Nexus Between Trust and Technological Innovation

This section delves into the symbiotic relationship between trust and innovation:

1. Fostering User Adoption:

Here, you elaborate on how trust drives user adoption. You discuss how user confidence in transparent practices and data privacy measures fuels their willingness to adopt and engage with technology, contributing to technology's successful integration.

2. Navigating Ethical Challenges:

This part delves into the ethical dimension of technology trends. You discuss how grounded ethical considerations ensure that tech innovations garner societal approval, avoid controversies, and build trust by adhering to responsible practices.

3. Enabling Collaboration:

You emphasize how trust facilitates cross-sector collaboration. By adopting shared tech standards and ethical practices, industries collaborate, accelerating innovation, and ensuring widespread adoption of technology trends.

4. Driving Regulatory Compliance:

This section highlights the interconnectedness of trust and regulatory compliance. You discuss how adhering to data protection regulations and ethical guidelines builds user trust, minimizes legal risks, and strengthens the foundation of technology adoption.

Cultivating Trust in Tech: A Shared Responsibility

This section outlines practical steps to cultivate trust in technology:

1. Transparency and Communication:

You delve into the significance of transparent communication. Tech companies must communicate data usage and AI processes clearly, empowering users with knowledge and fostering trust through understanding.

2. Regulatory Alignment:

Here, you emphasize the role of regulators in building trust. By creating and enforcing data protection laws and ethical standards, regulators ensure that technology adheres to responsible and accountable practices, enhancing user trust.

3. User Education:

You discuss the importance of educating users about tech trends. Informed users are more likely to engage confidently with technology, and education empowers them to make informed decisions about technology adoption.

4. Ethical Consideration:

This part stresses the ethical imperative in technology creation. By considering ethics from AI design to sustainable practices, tech creators enhance the reputation and societal impact of technology.

Conclusion: Trust as the Tech Enabler

As 2024 unfolds, technology trends underscore the paramount importance of trust. Trust not only underpins user adoption and regulatory compliance but also amplifies innovation and societal progress. The fusion of tech and trust empowers a future where technology is embraced with confidence, paving the way for a world where innovation thrives and users feel secure.

#Tech Trends 2024#Importance of Trust#Ethical AI#Data Privacy#Human-Centered Design#Sustainable Tech#Blockchain Transparency#Digital Well-Being.

1 note

·

View note

Text

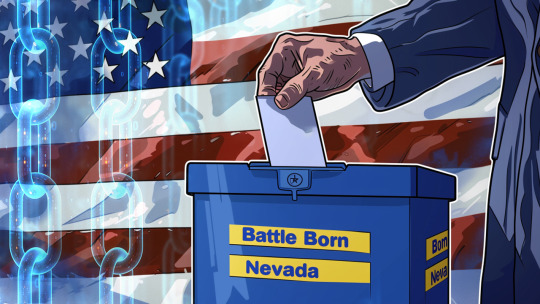

Nevada Joins the Blockchain Revolution for Election Integrity

The question of election integrity is a heated topic in the USA. With each election, accusations of irregularities often emerge, casting doubt on the process and fueling tension.

To address these concerns, Nevada is adopting blockchain technology to ensure transparency in the process. But this is not the only state, which is going to introduce innovative technology. States are increasingly turning to blockchain to solve the problem.

Nevada followed the pattern of Alaska and Georgia, which expressed interest in adopting blockchain-based solutions for elections. Using the blockchain, voting records are stored in an immutable ledger. These entries can’t be altered or tampered with.

Some say democracy is dead, while activism can be easily manipulated. In the age of increasing skepticism, blockchain can be the spark that reignites trust in the system. It will make election procedures more transparent and secure. This is a significant step forward in safeguarding democracy, which is currently at risk.

The United States has a four-year window before the next presidential election. It’s a chance to strengthen its electoral system and it looks as if they got down to business already.

6 notes

·

View notes

Text

Coinbase's Legal Battle with the SEC: A Push for Transparency and Clear Regulation

The ongoing tension between Coinbase and the U.S. Securities and Exchange Commission (SEC) has taken a new turn. In recent months, Coinbase has launched two significant legal actions against the SEC, reflecting the company's growing frustration with the regulatory environment for cryptocurrencies in the United States. These actions underscore the urgent need for transparency and clear rules in the rapidly evolving digital asset industry.

Lawsuit Over FOIA Requests

In June 2024, Coinbase filed lawsuits against both the SEC and the Federal Deposit Insurance Corporation (FDIC) for failing to comply with Freedom of Information Act (FOIA) requests. Coinbase's FOIA requests sought critical information on two fronts:

The SEC's View on Ethereum: Coinbase is particularly interested in how the SEC perceives Ethereum, especially after its transition to a proof-of-stake consensus mechanism. This shift has sparked debates about whether Ethereum should be classified as a security under current U.S. laws.

"Pause Letters": Coinbase also requested copies of "Pause Letters" referenced in an Office of Inspector General report. These letters could provide insight into the SEC's internal communications and strategies regarding the regulation of digital assets.

By taking legal action, Coinbase aims to compel these agencies to release the requested information. The company alleges that federal financial regulators are attempting to "cripple the digital-asset industry" and believes that greater transparency will shed light on the true motivations and actions of these regulators.

Petition for Rulemaking

The second significant legal action by Coinbase is its April 2023 lawsuit against the SEC, which seeks to force the agency to respond to a petition for rulemaking. Coinbase initially submitted this petition in July 2022, requesting formal guidance on the regulatory framework for the crypto industry. The SEC's prolonged silence prompted Coinbase to seek judicial intervention, hoping to secure a clear and actionable response.

This lawsuit highlights Coinbase's argument that the SEC's current approach—termed "regulation by enforcement"—is detrimental to the crypto industry. Coinbase asserts that the lack of clear rules creates uncertainty and stifles innovation. The company contends that formal guidance would provide the necessary clarity for businesses operating in the digital asset space.

Broader Context and Implications

These legal battles are part of a broader debate over the regulation of cryptocurrencies in the United States. The SEC has taken a stringent stance, asserting that most cryptocurrencies are securities and should be regulated as such. This perspective has led to numerous enforcement actions against various crypto companies, including Coinbase.

In March 2024, a federal judge ruled that most of the SEC's claims against Coinbase could proceed to trial, marking a significant setback for the company's efforts to dismiss the lawsuit. Coinbase argues that the SEC's aggressive stance is counterproductive and calls for a more collaborative approach to developing a comprehensive regulatory framework.

Aligning with Coinbase's Mission

These legal actions are not just strategic moves but are deeply aligned with Coinbase's mission statement of promoting financial freedom. By challenging the SEC and advocating for transparent and clear regulations, Coinbase is doing everything in its power to create an environment where digital assets can thrive. This dedication to financial freedom and innovation is at the core of Coinbase's goals, reflecting its commitment to transforming the financial landscape.

Conclusion

Coinbase's legal actions against the SEC and FDIC reflect a pivotal moment in the relationship between the crypto industry and U.S. regulators. By demanding transparency and clear rules, Coinbase is advocating for a regulatory environment that supports innovation while protecting investors. As this legal battle unfolds, it will undoubtedly shape the future of cryptocurrency regulation in the United States and potentially set precedents for other jurisdictions around the world.

#Coinbase#SEC#Cryptocurrency#CryptoRegulation#Bitcoin#Ethereum#FinancialFreedom#FOIA#Transparency#DigitalAssets#CryptoNews#Blockchain#LegalBattle#CryptoCommunity#CryptoInnovation#CryptoLaw#CoinbaseVsSEC#CryptoUpdates#DigitalCurrency#CryptoEconomy#CryptoLawyers#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

9 notes

·

View notes

Text

10 Fun Facts about Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has taken the world by storm since its inception in 2009. Its revolutionary technology and decentralized nature have captivated the imaginations of tech enthusiasts, investors, and even the general public. Here are ten fun facts about Bitcoin that highlight its unique characteristics and its impact on the world. 1. The Mysterious…

3 notes

·

View notes

Text

Spotify’s Discovery Mode: The New Payola Hurting Indie Artists

Making a Scene Presents – Spotify’s Discovery Mode: The New Payola Hurting Indie Artists In the early days of the music industry, the word “payola” was practically a scandal. It referred to the shady practice of record labels secretly paying radio DJs to play their artists’ songs, manipulating what listeners heard and artificially inflating a track’s popularity. It was unethical, it was illegal,…

#Artist Direct Payment#Audius Music Platform#blockchain music industry#Blockchain Music Streaming#decentralized music platforms#Decentralized Music Revolution#Discovery Mode Criticism#Indie Artist Advocacy#Indie Artist Streaming Income#Indie Music Industry#music industry transparency#Music Platform Accountability#Music Streaming Alternatives#Music Streaming Royalty Rates#Spotify Algorithm Manipulation#Spotify Artist Income#Spotify Discovery Mode#Spotify Music Industry Criticism#Spotify Payola#Streaming Platform Exploitation#Web3 Music Platforms

0 notes

Text

Why Trust and Transparency with Blockchain Matter inside the Digital Age

In contemporary digital generation, agree with and transparency are vital factors in various industries, from finance to healthcare and supply chain management. However, traditional structures regularly fail to provide the extent of responsibility and safety wished. This is in which blockchain era is available in. The integration of blockchain guarantees trust and transparency with blockchain, making it a game-changer within the virtual international.

Understanding Blockchain Technology

Blockchain is a decentralized ledger that data transactions in a comfy and immutable manner. Each transaction is confirmed by a network of computers and saved in a block, that is related to the previous block, forming a series. This system guarantees that once information is entered, it cannot be altered, promoting transparency and trust.

The Importance of Trust in the Digital Age

With the upward push of cyber threats, information breaches, and fraudulent sports, trust in virtual transactions has grow to be a sizable problem. Blockchain eliminates the need for intermediaries via offering a transparent and tamper-evidence machine where transactions are proven through consensus mechanisms. This enhances protection and builds self assurance among users.

How Blockchain Enhances Transparency

Immutable Records – Blockchain statistics cannot be altered or deleted, ensuring the integrity of statistics.

Decentralization – No single entity controls the blockchain, decreasing the danger of corruption or manipulation.

Auditability – Every transaction is recorded and can be traced returned, making economic and business operations more accountable.

Smart Contracts – These self-executing contracts make certain that agreements are fulfilled with out human intervention, lowering fraud and misinterpretation.

Real-World Applications of Trust and Transparency with Blockchain

Finance: Blockchain prevents fraud in banking by way of ensuring obvious transactions.

Healthcare: Patients' medical facts are securely stored and shared without unauthorized access.

Supply Chain: Companies can music merchandise from manufacturing to delivery, preventing counterfeiting.

Voting Systems: Blockchain guarantees fair and tamper-evidence elections.

Conclusion

In the digital age, trust and transparency are more important than ever. Trust and transparency with blockchain technology provide a comfortable and reliable option to various virtual challenges. By adopting blockchain, corporations and people can make sure statistics integrity, cast off fraud, and foster a more transparent atmosphere.

0 notes

Text

TigerSwap – Platforma Inovatoare de Tranzacționare și Yield Farming

TigerSwap se remarcă ca o soluție descentralizată în universul DeFi, oferind utilizatorilor un mediu rapid, sigur și economic pentru tranzacționarea și schimbul de tokenuri. Concepută pentru a maximiza experiența investitorilor și traderilor, TigerSwap combină tehnologia blockchain de ultimă oră cu un design intuitiv și funcționalități avansate de yield farming și staking, fiind o alegere ideală…

#evoluție#costuri reduse#tranzacționare rapidă#swap tokenuri#ecosistem DeFi#fintech#digital assets#blockchain transparency#transparență#educație cripto#Parteneriate Strategice#investiții cripto#interfață intuitivă#dashboard#suport tehnic#market making#dezvoltare continuă#peer-to-peer#rapiditate#audit securitate#TigerSwap#securitate#blockchain#dex#defi#staking#Inovație.#Scalabilitate#Exchange Descentralizat#Lichiditate

0 notes

Text

Blockchain is Revolutionizing Supply Chain Transparency!

Sourcing transparency has always been a challenge-hidden data, counterfeits, and unreliable suppliers make it hard to track products. But blockchain is changing the game in 2025!

1.End-to-End Visibility – Every step, from raw material sourcing to final delivery, is securely recorded and verifiable. 2. Instant Access to Data – No more delays! Suppliers, manufacturers, and buyers can see real-time updates, improving trust. 3. Smart Contracts Automate Processes – Payments, compliance checks, and order fulfillment happen seamlessly without manual intervention. 4. Stronger ESG Compliance – Consumers demand ethical sourcing. Blockchain provides verifiable proof of sustainability efforts.

Is your company leveraging blockchain yet?

If not, what’s stopping you? Let’s discuss how this tech can make your supply chain more transparent and efficient.

0 notes

Video

Blockchain Basics: A Simple Guide

0 notes

Text

Global trade is constantly evolving, influenced by technological advancements, changing market demands, and shifting regulatory landscapes. In recent years, one of the most transformative technologies to emerge in the world of trade is blockchain. Originally known as the technology behind cryptocurrencies like Bitcoin, blockchain has found a much broader application in revolutionizing how businesses operate, particularly in the realm of global trade. By providing a transparent, secure, and decentralized platform for conducting transactions, blockchain has the potential to reshape how goods, services, and data move across borders.

0 notes

Text

Can Blockchain Technology Improve Personal Loan Approvals?

The financial sector is rapidly evolving with new technologies, and blockchain is one of the most promising innovations transforming the personal loan industry. Traditionally, loan approvals have been time-consuming, requiring manual document verification, credit score analysis, and financial background checks. Blockchain technology is changing this by making the process faster, more secure, and more transparent.

With blockchain, lenders can streamline identity verification, enhance credit risk assessment, and prevent fraud, making personal loans more accessible and efficient. In this article, we explore how blockchain is improving loan approvals and why it could be the future of digital lending.

🔗 For hassle-free personal loan applications, visit FinCrif Personal Loan.

1. How Blockchain Enhances Loan Approvals

Faster and More Reliable Identity Verification

One of the biggest hurdles in personal loan approvals is verifying a borrower’s identity. Traditional Know Your Customer (KYC) processes require applicants to submit documents such as Aadhaar, PAN, and bank statements, which banks manually verify. This process can take several days, causing delays.

Blockchain eliminates redundant verification by storing identity records in a tamper-proof, decentralized ledger. Once an identity is verified and recorded on the blockchain, it can be accessed by lenders instantly, reducing processing time and ensuring authenticity.

Alternative Credit Scoring for Faster Loan Approvals

Many individuals struggle to get personal loans due to a lack of credit history or low CIBIL scores. Traditional lenders primarily rely on credit bureau scores, which do not always provide a complete picture of a borrower's financial behavior.

Blockchain allows lenders to use alternative data sources, such as utility bill payments, mobile phone transactions, and online spending patterns, to assess creditworthiness. This makes personal loans accessible to self-employed individuals, gig workers, and those without a strong credit history.

Automated Loan Processing with Smart Contracts

A smart contract is a self-executing agreement stored on a blockchain that automatically enforces the terms of a loan when certain conditions are met. These contracts eliminate the need for human intervention, making loan approvals much faster.

For example, once a borrower's identity and financial records are verified, a smart contract can instantly approve the loan and trigger fund disbursement. This removes bureaucratic delays, helping borrowers access funds within minutes instead of days.

2. Improved Security and Fraud Prevention

Prevention of Identity Theft and Fake Applications

One of the biggest challenges in personal lending is fraud. Many loan scams involve forged documents, fake identities, or manipulated financial records. Blockchain prevents fraud by ensuring that all transactions and data entries are permanent, transparent, and tamper-proof.

Lenders can verify borrower details on a shared blockchain network, making it impossible for fraudsters to manipulate loan applications. This enhances trust and reduces the risk of defaults.

Eliminating Credit Report Manipulation

In the current system, borrowers can sometimes manipulate their credit reports by temporarily improving their credit utilization before applying for a loan. Blockchain stores real-time financial data, making it impossible to alter past records. This ensures that lenders always have an accurate financial picture of borrowers, reducing lending risks.

3. Faster Loan Disbursement with Blockchain

In traditional lending, once a loan is approved, it may take several days for funds to be transferred due to interbank processes and verification checks. Blockchain speeds up disbursal by enabling direct peer-to-peer transactions without intermediary banks.

With blockchain-based digital wallets, borrowers can receive loan amounts instantly after approval, making it a game-changer for emergency loans and urgent financial needs.

🔗 Looking for a quick loan disbursal? Explore FinCrif Personal Loan.

4. Transparency and Reduced Loan Processing Costs

Lower Processing Fees for Borrowers

Loan processing involves multiple intermediaries, such as credit bureaus, third-party verifiers, and bank officers, each adding costs that are passed on to borrowers. Blockchain eliminates many of these middlemen by automating verification and reducing paperwork.

This leads to lower processing fees and better interest rates, making personal loans more affordable.

Complete Transparency in Loan Terms

Many borrowers struggle with hidden charges, fluctuating interest rates, and complex loan agreements. Blockchain ensures absolute transparency by recording all loan terms on an immutable ledger. Borrowers can access their loan history, EMI schedules, and outstanding balances without worrying about unexpected changes in loan conditions.

5. Challenges in Implementing Blockchain for Personal Loans

Despite its advantages, blockchain adoption in personal lending faces challenges, including regulatory concerns and technical barriers.

Regulatory Uncertainty: Many governments are still developing policies on blockchain-based lending, which slows adoption.

Integration with Existing Banking Systems: Most financial institutions operate on centralized databases, making integration with decentralized blockchain networks complex.

User Awareness: Many borrowers are unfamiliar with blockchain technology and may hesitate to trust a fully automated loan approval system.

However, as blockchain regulations become clearer and financial institutions invest in digital transformation, these challenges are expected to decrease.

6. The Future of Blockchain in Personal Loan Approvals

As blockchain technology continues to evolve, it will play an even bigger role in making personal loans more accessible, secure, and efficient. Some expected advancements include:

Instant Global Loan Access: Borrowers will be able to apply for and receive loans across borders without waiting for traditional bank approvals.

AI and Blockchain Integration: Combining artificial intelligence with blockchain will further enhance loan approvals by analyzing borrower behavior in real-time.

Decentralized Lending Platforms: More peer-to-peer (P2P) lending models will emerge, allowing borrowers to connect directly with lenders, bypassing traditional banks.

🔗 Be part of the future of lending! Explore AI-powered loan solutions at FinCrif Personal Loan.

Blockchain technology has the potential to redefine personal loan approvals by making them faster, more transparent, and secure. By reducing reliance on credit bureaus, enabling instant identity verification, and preventing fraud, blockchain can improve financial accessibility for millions of borrowers.

While challenges remain, the future of personal lending is increasingly digital. As blockchain adoption grows, borrowers can expect lower costs, faster approvals, and a more efficient lending experience.

For a seamless and secure personal loan application, visit FinCrif Personal Loan and explore the latest AI-driven financial solutions.

#Blockchain in personal loans#Blockchain loan approval#Blockchain technology in lending#Personal loan blockchain#Faster loan approvals with blockchain#Blockchain-based lending#Secure loan processing#Decentralized lending platforms#Smart contracts for loans#Instant loan approvals#How blockchain improves lending#Blockchain in financial services#Digital lending with blockchain#Alternative credit scoring with blockchain#AI and blockchain in loans#Fraud prevention in personal loans#Transparent loan processing#Peer-to-peer lending blockchain#Future of blockchain in banking#Secure identity verification for loans#finance#loan apps#personal loans#loan services#personal loan#fincrif#personal loan online#nbfc personal loan#bank#personal laon

0 notes

Text

Powered By Bitcoin: A Future Worth Building

Bitcoin is more than a currency—it's the foundation for a future built on transparency, empowerment, and innovation. In a world that’s increasingly digital and interconnected, Bitcoin offers a vision of a decentralized future where industries are transformed, and individuals gain unprecedented financial autonomy.

What would a world powered by Bitcoin look like? Let’s explore this inspiring possibility.

Chapter 2: The Industries Bitcoin is Already Transforming

Finance and Banking Bitcoin is already reshaping the financial world. As a store of value, it challenges traditional banking systems that rely on inflationary fiat currencies. Bitcoin enables seamless cross-border transactions, reducing the need for intermediaries and lowering fees for remittances. For individuals in countries with unstable currencies, Bitcoin offers financial stability and a lifeline to global markets.

Energy and Sustainability Bitcoin mining, often criticized for its energy usage, is becoming a catalyst for renewable energy innovation. Miners are increasingly harnessing excess or stranded energy, converting it into economic value. Imagine a future where Bitcoin mining incentivizes the growth of renewable energy infrastructure, creating a cleaner and more efficient energy grid.

Technology and Innovation Bitcoin has sparked groundbreaking advancements, including the Lightning Network, which enables fast, low-cost payments. This technology is just the beginning—Bitcoin’s underlying blockchain is inspiring innovations across industries, from supply chain management to secure digital identities.

Chapter 3: The Bigger Vision for Bitcoin

Empowering Individuals Bitcoin’s decentralized nature gives financial sovereignty to billions of people who are unbanked or underbanked. It removes barriers to entry, allowing anyone with an internet connection to participate in the global economy. This empowerment shifts power from centralized institutions to individuals, fostering freedom and independence.

A Transparent and Trustless Economy Imagine a world where trust isn’t needed because it’s built into the system. Bitcoin’s immutable ledger promotes transparency and reduces corruption, especially in industries like supply chain management and charitable donations. With Bitcoin, every transaction is visible and verifiable, fostering a culture of accountability.

Global Unity through a Single Standard Bitcoin transcends borders, languages, and political systems. It offers a universal financial standard, uniting people across the globe. By eliminating the complexities of exchange rates and centralized controls, Bitcoin creates a level playing field for international trade and collaboration.

Chapter 4: Inspiring Others to Think Big

A Call to Action The Bitcoin revolution isn’t something to wait for—it’s something to participate in. Take the first step: learn about Bitcoin, invest in it, or advocate for its adoption in your community. Small actions build momentum, and together, we can create a world powered by Bitcoin.

Chapter 5: Conclusion

The future isn’t just something we wait for—it’s something we build. Bitcoin gives us the tools. Let’s use them to shape a world where transparency, empowerment, and innovation are the norm.

Join the revolution, and let’s create a world truly powered by Bitcoin.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin: bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#DecentralizedFinance#Blockchain#FutureOfFinance#DigitalCurrency#Innovation#RenewableEnergy#FinancialFreedom#BitcoinRevolution#CryptoCommunity#Transparency#BitcoinMining#Empowerment#GlobalUnity#TechInnovation#Sustainability#Decentralization#DigitalEconomy#BitcoinHodl#financial empowerment#unplugged financial#globaleconomy#financial experts#financial education#finance

3 notes

·

View notes

Text

How Universal Music Group and Spotify Rewrote the Rules—At the Expense of Indie Artists

Making a Scene Presents How Universal Music Group and Spotify Rewrote the Rules—At the Expense of Indie Artists In a move that sent ripples through the music world, Spotify announced in late 2023 that artists whose tracks fail to reach 1,000 annual streams would no longer receive any royalties. While the platform justified this decision as an effort to combat streaming fraud and better allocate…

#1000 stream minimum#artist compensation#artist exploitation#artist-centric model#Black Sheep lawsuit#blockchain music industry#decentralized music platforms#digital music economy#fair pay for musicians#indie artist pay#indie artist struggle#major label profits#music industry lawsuits#music industry reform#music streaming ethics#royalty transparency#Spotify#Spotify equity deal#Spotify royalty changes#Spotify UMG criticism#streaming inequality#streaming platform bias#streaming threshold#UMG#UMG Spotify partnership#Universal Music Group

0 notes